HVAC 2030: China

In March 2022, BSRIA announced it had been working on a strategic study exploring scenarios for what is likely to happen by the end of the decade, based on the current status of the residential HVAC market and known future enablers for change. BSRIA set out to look at the next few years until 2030, with a long-term view of the winning and losing products and solutions in residential heating in the USA, Europe and China. This is a hot topic as the industry enters a decisive decade for climate action and HVAC products and systems play a key role in the construction industry’s efforts to minimise carbon emissions in buildings.

The Chinese HVAC market is the biggest in the world and heating forms an important 42% of Global HVAC sales. The government pushes for a move towards carbon neutrality by 2060 and has been forced to address air quality issues due to high pollution levels caused by Chinese factories.

In China, the sales of gas boilers will decrease in the next five years because of the decreasing amount of coal to gas projects. The Coal to Gas policy was, historically, the main driver for gas boiler sales, as it was pushed by the government in the late 2010s.

What happens in the second half of the 2020s is very challenging to forecast as a lot depends on the central government’s five-year plans, the next of which is expected in 2026. Heating markets are heavily policy-dependent; consequently, we must consider scenario assumptions. For a longer-term forecast BSRIA’s methodology is based on establishing two opposing scenarios:

These scenarios are defined very carefully in our model with several assumptions regarding government planning, renewable policies, subsidies, economy development, gas supply and energy price fluctuations, and technology development, to name a few.

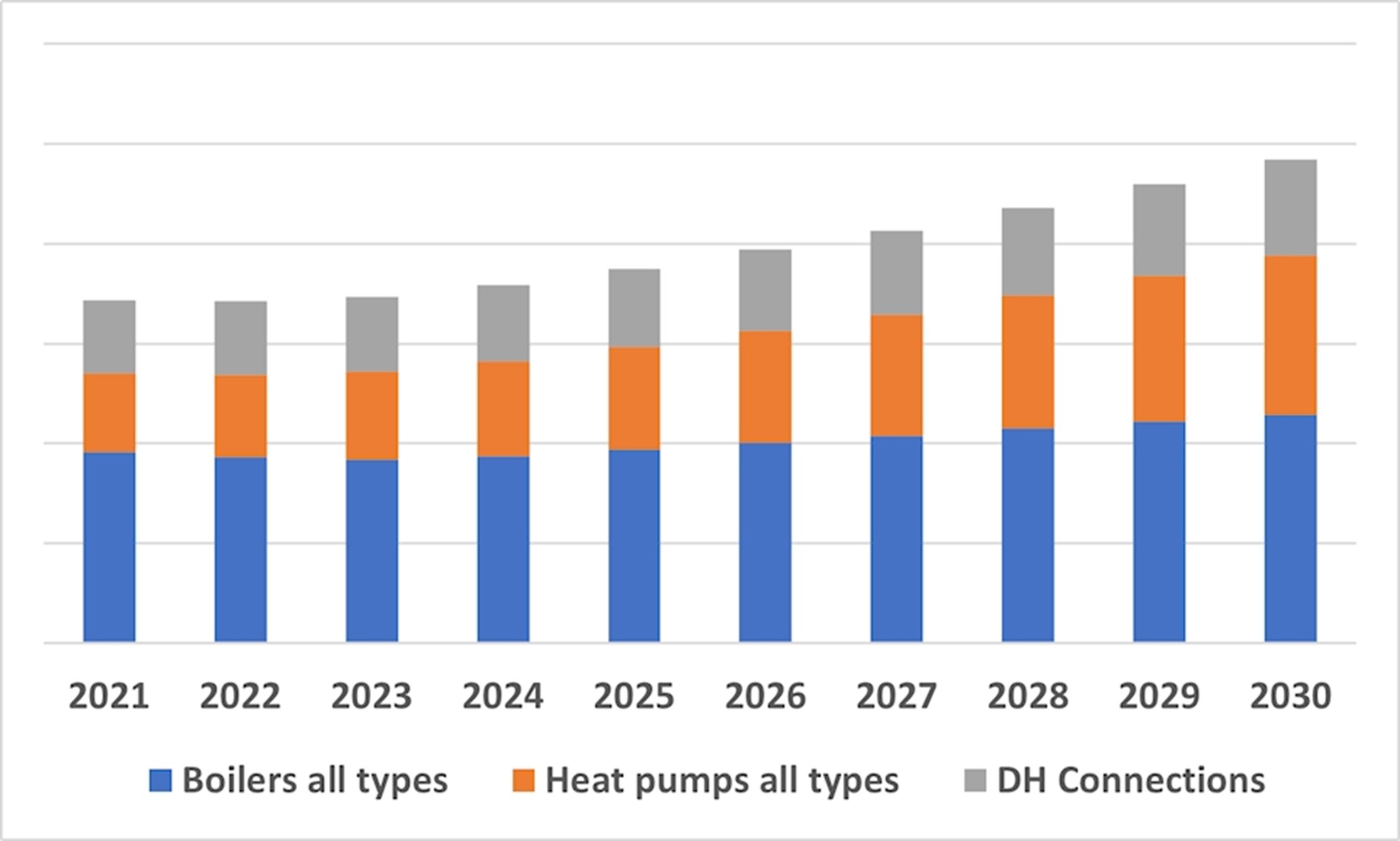

Based on the above, we anticipate that in the progressive scenario boilers will grow faster than in the conservative scenario as we assume better economy and favourable energy prices. This is because the government pushes natural gas to replace other fossil fuels (mostly coal) before 2030, while they are more likely to push for green electricity in the next decade, from 2030 onwards, in subsequent five-year plans. Well over 90% of gas boiler sales are still low-efficiency, and there is scope for replacement of those with more energy saving units, in a replacement-based resurgent market, supported by governmental policy. This is precisely the market that is at present dominated by international manufacturers.

And as there is no subsidy for heat pumps, other than the Coal to Electricity projects (also diminishing) and no ban on fossil fuels, the share of heat pumps is set to remain between flat to very moderate growth in the shorter term but to grow faster towards the end of the decade. This forecast is supported by fluctuating energy prices, the decreasing price of heat pumps, and growing consumer awareness of the technology.

The situation will be very different from region to region as energy prices differ and there are at times regional incentives/policies to encourage change and consequently make one product more competitive than others. Other factors include the existence in a region of a gas grid or PV, wind power farms, and the type of houses to heat. Heat pumps are mainly used either in high-end villas in suburban areas, or cottages in rural areas, but are not seen where space is limited, particularly in flats with access to the gas grid. Flats are the dominant residential type in the country.

Only a minority of the population use air-to-air heat pumps, that is single splits and mini-VRF, as a primary heating source. District heating is encouraged and will grow in the North of the country.

| Market evolution in the progressive scenario 2021 – 2030, by volume |

|

For further information about BSRIA’s HVAC 2030 study covering the US, Europe and China or BSRIA’s other publications, please contact us:

- European sales enquiries: BSRIA UK: www.bsria.com/uk/

- America sales enquiries: www.bsria.com/us/

- China sales enquiries: BSRIA China: https://www.bsria.com/cn

This article originally appeared on the BSRIA website in March 2022.

--BSRIA

[edit] Related articles on Designing Buildings

- BSRIA articles.

- BSRIA Compressor Study September 2020 - The Americas and China.

- BSRIA study shows US industrial refrigeration market worth US$2bn.

- BSRIA.

- China - clean, green buildings of the future.

- China's residential air conditioning prices set to increase.

- Global Air Conditioning Study 2018.

- Heat pumps.

- HVAC.

Featured articles and news

Gregor Harvie argues that AI is state-sanctioned theft of IP.

Preserving, waterproofing and decorating buildings.

Many resources for visitors aswell as new features for members.

Using technology to empower communities

The Community data platform; capturing the DNA of a place and fostering participation, for better design.

Heat pump and wind turbine sound calculations for PDRs

MCS publish updated sound calculation standards for permitted development installations.

Homes England creates largest housing-led site in the North

Successful, 34 hectare land acquisition with the residential allocation now completed.

Scottish apprenticeship training proposals

General support although better accountability and transparency is sought.

The history of building regulations

A story of belated action in response to crisis.

Moisture, fire safety and emerging trends in living walls

How wet is your wall?

Current policy explained and newly published consultation by the UK and Welsh Governments.

British architecture 1919–39. Book review.

Conservation of listed prefabs in Moseley.

Energy industry calls for urgent reform.

Heritage staff wellbeing at work survey.

A five minute introduction.

50th Golden anniversary ECA Edmundson apprentice award

Showcasing the very best electrotechnical and engineering services for half a century.

Welsh government consults on HRBs and reg changes

Seeking feedback on a new regulatory regime and a broad range of issues.